The European Audiovisual Observatory, part of the Council of Europe in Strasbourg, has published a new edition of its annual report on the main audiovisual players in Europe. Author of the report "Top players in the European audiovisual industry - ownership and concentration" is Laura Ene Iancu, analyst in the Market Information department of the Observatory.

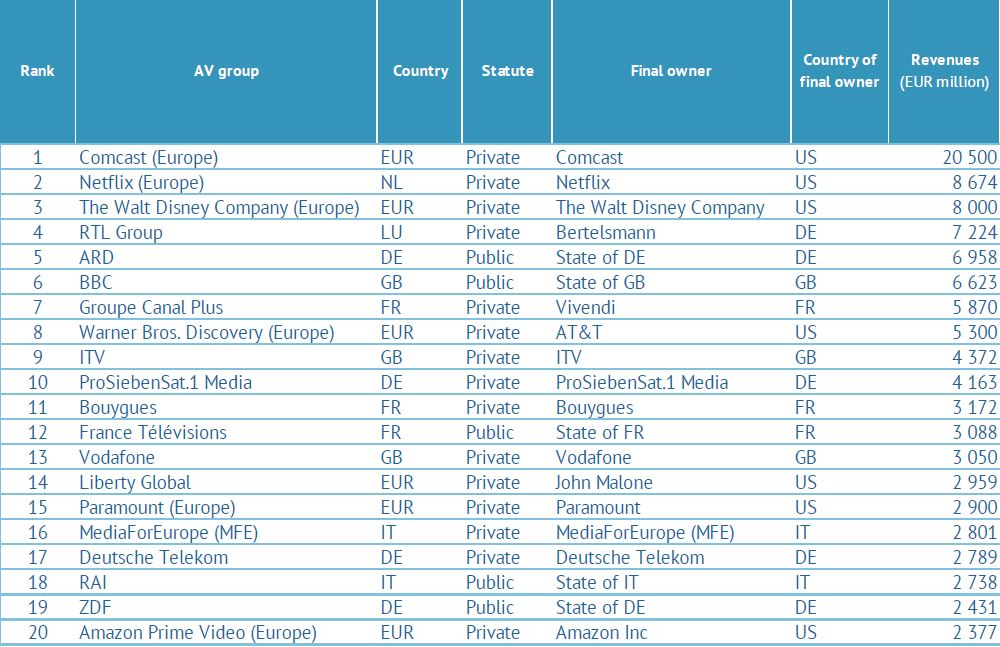

Revenue growthCumulative operating revenues of the top 100 audiovisual groups in Europe grew by 23% in 2022 compared to 2016, driven mainly by private companies and SVOD services such as Netflix and Amazon Prime Video.

Market structure: The pay-TV market remained highly concentrated in 2022, with the top 10 operators accounting for 60% of subscriptions. The SVOD market was even more concentrated, with 90% of subscriptions across the top 10 OTT platforms1.

US influence: The share of US interests in the Top 100 revenues increased to 36% in 2022, mainly due to SVOD services and US-supported channels such as Sky and Disney+.

Diversity of the marketsThe audiovisual landscape in Europe is very heterogeneous, with different market structures and levels of concentration in different countries.

Link to the Press release